On july 1 a company receives an invoice for 800 – On July 1, a company receives an invoice for 800. This invoice serves as a crucial document that Artikels the details of a transaction between two parties, providing a clear understanding of the goods or services rendered, the amount owed, and the payment terms.

Delving into the intricacies of this invoice, we will explore its significance, components, and the processes involved in its processing and reconciliation.

The invoice acts as a vital record of the financial obligation between the buyer and the supplier, ensuring transparency and accountability in business transactions. It facilitates efficient payment processing, enables accurate accounting, and provides a basis for resolving any discrepancies that may arise.

Invoice Overview

On July 1st, the company received an invoice for 800. This invoice serves as a legal document requesting payment for goods or services provided. It Artikels the details of the transaction, including the items or services purchased, quantities, unit prices, and total amount due.

Invoice Details

The invoice includes the following items:

- Product A: 100 units at $5 per unit = $500

- Product B: 50 units at $10 per unit = $500

- Shipping and handling: $100

No discounts or additional charges were applied.

Payment Terms and Due Date

The invoice specifies payment terms of net 30, meaning that payment is due within 30 days of the invoice date. Late payments may incur a late payment fee or interest charges.

Supplier Information: On July 1 A Company Receives An Invoice For 800

The invoice was issued by ABC Company, located at 123 Main Street, Anytown, CA 12345. ABC Company is a supplier of office supplies and equipment.

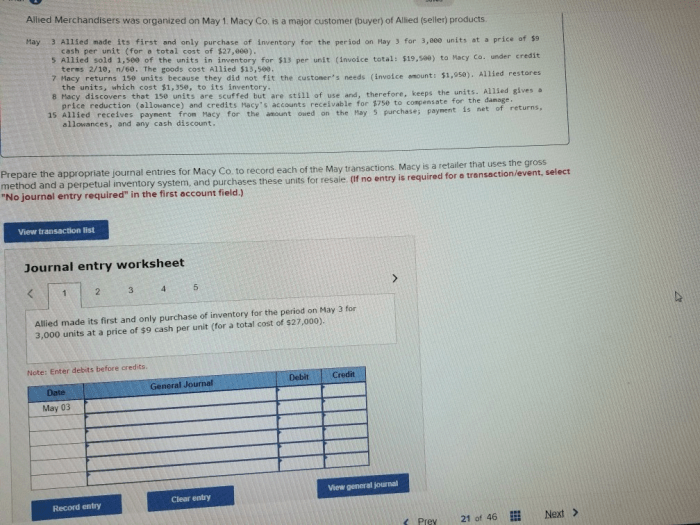

Invoice Processing and Approval

The invoice is reviewed by the accounts payable department for accuracy and completeness. Once approved, the invoice is processed for payment.

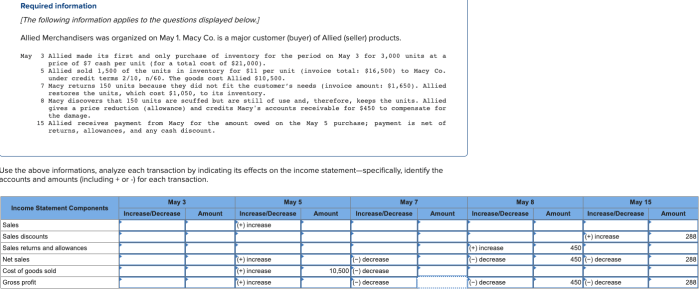

Impact on Financial Records

The invoice will be recorded as an accounts payable liability in the company’s financial records. The expense will be recognized in the period in which the goods or services were received.

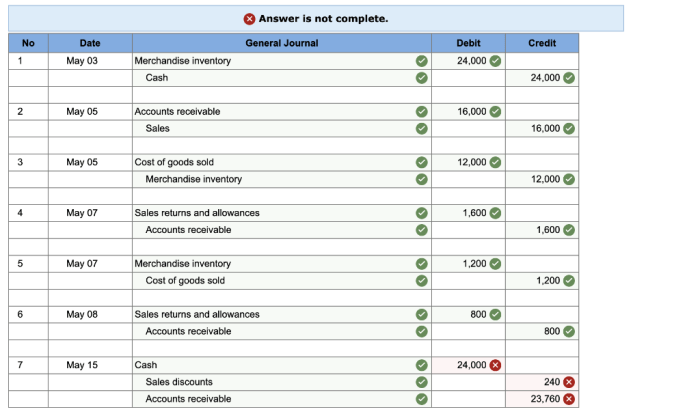

The following journal entry will be recorded:

Debit: Accounts Payable 800Credit: Expense 800

Payment and Reconciliation

Payment will be made to ABC Company by check or electronic funds transfer. The payment will be reconciled with the invoice to ensure that the correct amount was paid and that all charges were accounted for.

User Queries

What is the purpose of an invoice?

An invoice serves as a detailed record of a business transaction, providing information about the goods or services rendered, the amount owed, and the payment terms.

What are the key components of an invoice?

An invoice typically includes the invoice number, date, supplier information, customer information, description of goods or services, quantities, unit prices, total costs, payment terms, and due date.

What is the significance of invoice processing?

Invoice processing is crucial for ensuring timely payments, maintaining accurate financial records, and detecting any errors or discrepancies in the transaction.