How much federal income tax was withheld from Rebecca’s paycheck? This is a crucial question that delves into the intricacies of federal income tax withholding, a significant aspect of personal finance. Understanding the factors that influence withholding, the methods used to calculate it, and strategies for adjusting it empowers individuals to optimize their financial well-being.

This comprehensive guide will provide a thorough examination of federal income tax withholding, equipping you with the knowledge to navigate this complex topic effectively.

Overview of Federal Income Tax Withholding

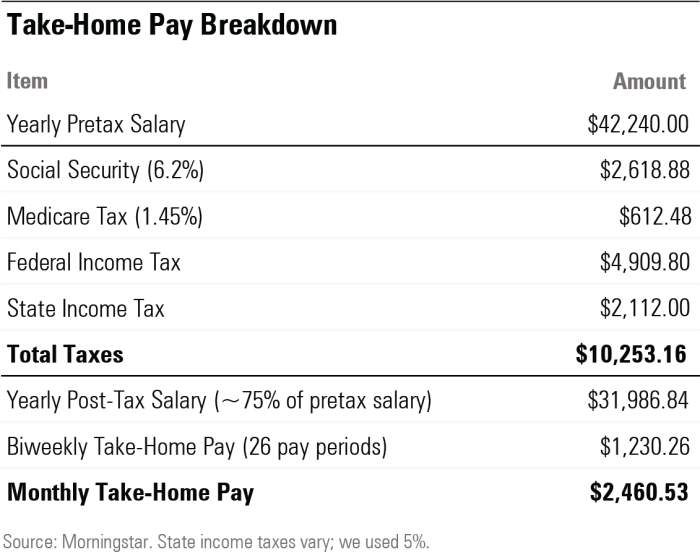

Federal income tax withholding is a system where employers deduct a certain amount of money from an employee’s paycheck to pay towards their federal income tax liability. This withholding is based on the employee’s estimated annual tax liability, which is determined using a combination of tax brackets and withholding rates.

The purpose of withholding is to ensure that employees pay their fair share of taxes throughout the year, rather than having to pay a large sum at tax time.

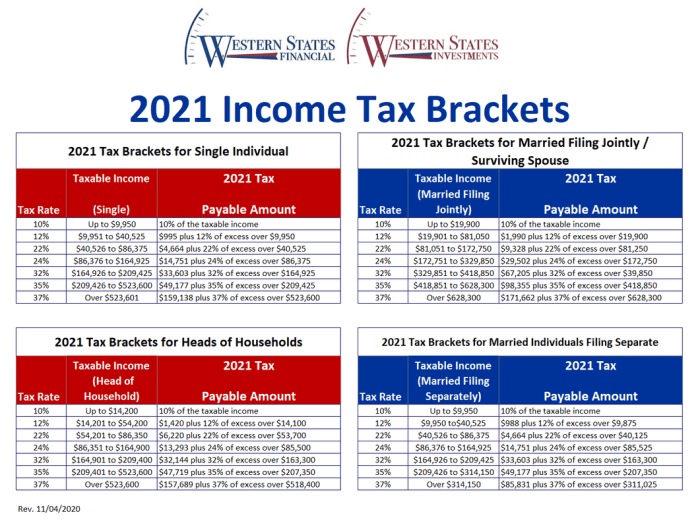

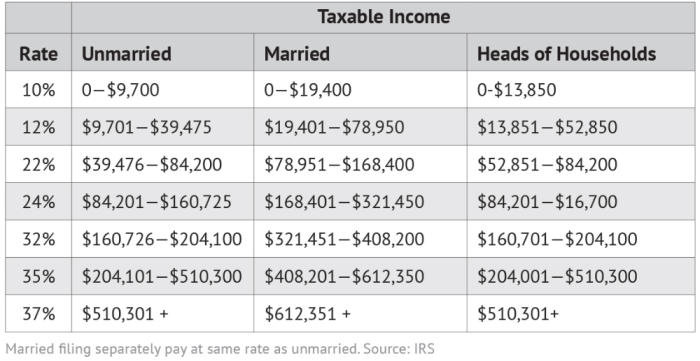

The tax brackets and withholding rates are set by the Internal Revenue Service (IRS) and are adjusted annually for inflation. The brackets are based on the employee’s filing status and income. The withholding rates are a percentage of the employee’s wages that is withheld for taxes.

Factors Affecting Rebecca’s Withholding

The amount of federal income tax withheld from Rebecca’s paycheck can be influenced by several factors, including:

- Filing status:The IRS recognizes different filing statuses, such as single, married filing jointly, and head of household. Each filing status has its own set of tax brackets and withholding rates.

- Number of allowances claimed:Allowances are deductions that reduce the amount of tax withheld from an employee’s paycheck. Rebecca can claim allowances for herself, her spouse, and any dependents she supports.

- Additional income sources:If Rebecca has income from sources other than her job, such as investments or self-employment, this can affect her withholding.

Methods for Calculating Withholding: How Much Federal Income Tax Was Withheld From Rebecca’s Paycheck

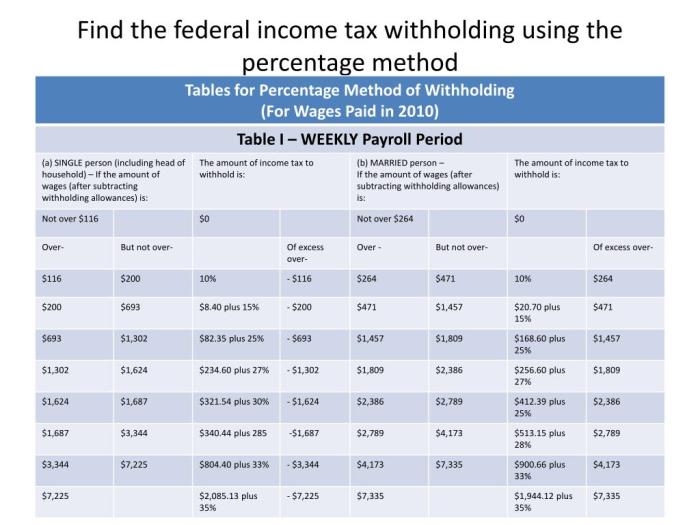

There are two main methods used to calculate federal income tax withholding: the percentage method and the wage bracket method.

Percentage method:Under this method, a flat percentage of Rebecca’s wages is withheld for taxes. The percentage is determined based on her filing status and the number of allowances she claims.

Wage bracket method:This method uses a series of tax brackets to determine the amount of tax withheld. Rebecca’s wages are placed in the appropriate bracket, and the corresponding withholding rate is applied.

The W-4 form is used to determine Rebecca’s withholding. This form is completed by employees and submitted to their employer. It provides information about Rebecca’s filing status, allowances, and any additional income sources.

How to Find the Withholding Amount

Rebecca can find the amount of federal income tax withheld from her paycheck by looking at her pay stub or online payroll statement. The withholding amount is typically listed in a section called “Federal Income Tax Withheld.” It is important to note that this amount is an estimate, and the actual amount of tax Rebecca owes may vary when she files her tax return.

Strategies for Adjusting Withholding

If Rebecca’s withholding is not accurate, she can adjust it by completing a new W-4 form and submitting it to her employer. Claiming more allowances will reduce her withholding, while claiming fewer allowances will increase her withholding.

Adjusting withholding may be beneficial if Rebecca’s income or circumstances change. For example, if she gets married or has a child, she may want to claim more allowances to reduce her withholding.

Additional Considerations

In addition to the factors discussed above, there are a few other considerations that may affect Rebecca’s federal income tax withholding:

- State and local income taxes:Some states and localities have their own income taxes, which can be withheld from Rebecca’s paycheck in addition to federal income tax.

- Retirement contributions:Contributions to retirement accounts, such as 401(k) plans, can reduce Rebecca’s taxable income, which can in turn reduce her withholding.

- Dependent care expenses:Rebecca may be able to claim a tax credit for dependent care expenses, which can also reduce her withholding.

FAQ Guide

What factors can affect the amount of federal income tax withheld from Rebecca’s paycheck?

Factors that can influence withholding include Rebecca’s filing status, the number of allowances she claims on her W-4 form, and any additional income she earns.

How can Rebecca adjust her withholding if it is not accurate?

Rebecca can adjust her withholding by completing a new W-4 form and submitting it to her employer. She can choose to claim more or fewer allowances, which will impact the amount of tax withheld from her paycheck.

What are some additional factors that may affect Rebecca’s federal income tax withholding?

Additional factors that may affect Rebecca’s withholding include state and local income taxes, retirement contributions, and dependent care expenses.