An s corporation may have only two classes of stock – An S corporation, a type of closely held business entity, is subject to specific rules regarding its stock classes. Understanding these rules is crucial for business owners seeking the benefits of S corporation status. This article explores the concept of stock classes in S corporations, their tax implications, legal considerations, and business implications, providing valuable insights for navigating the complexities of S corporation formation and management.

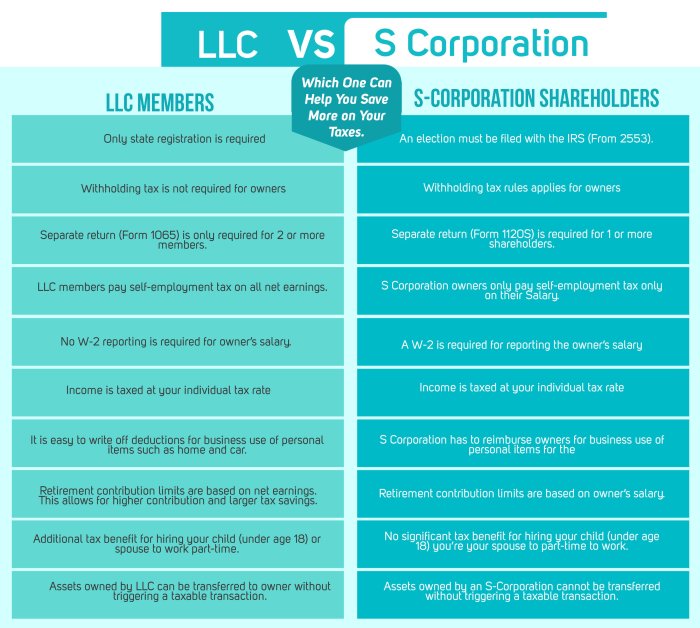

S corporations are limited to issuing only two classes of stock, a common stock and a preferred stock. This restriction aims to prevent the creation of multiple classes of stock with varying rights and privileges, which could lead to tax complications and potential abuse of the S corporation election.

S Corporation Stock Classes

An S corporation is a closely held corporation that elects to pass corporate income, losses, deductions, and credits through to its shareholders for federal tax purposes. S corporations are limited to having only two classes of stock, which must be common stock and nonvoting preferred stock.

Purpose and Advantages of Two Stock Classes

- Avoids the potential for multiple classes of stock to be treated as separate entities for tax purposes.

- Simplifies the corporate structure and reduces the administrative burden.

- Maintains control within the corporation by limiting voting rights to common shareholders.

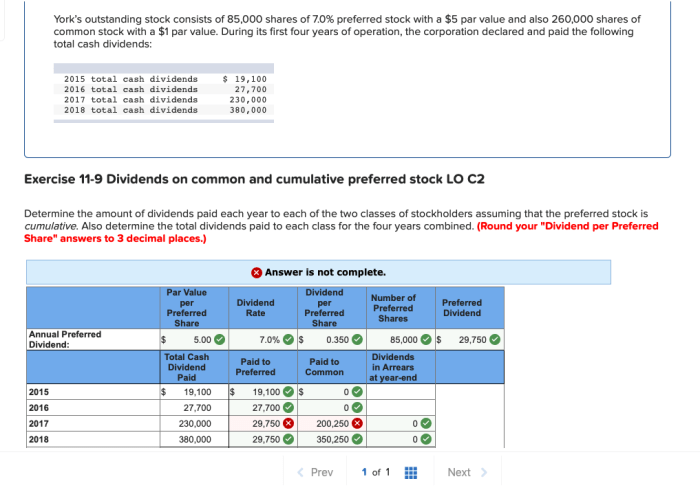

Tax Implications of Stock Classes

The IRS treats different classes of stock in an S corporation as follows:

- Common stock:Entitled to vote and receive dividends.

- Nonvoting preferred stock:Entitled to receive dividends but not to vote.

Multiple classes of stock can lead to tax issues if they are not structured properly. For example, if preferred stock has a fixed dividend rate that is not proportional to its share of corporate earnings, it may be considered a “second class of stock” and the S corporation election may be terminated.

Legal and Regulatory Considerations: An S Corporation May Have Only Two Classes Of Stock

State and federal laws govern the issuance and classification of stock in S corporations.

Corporate Charter and Bylaws

The corporate charter and bylaws define the classes of stock that an S corporation can issue. They must be drafted carefully to ensure that the corporation meets the requirements for S corporation status.

Business Implications of Stock Classes

Having only two classes of stock in an S corporation can have the following business implications:

- Ownership and control:Common shareholders have voting rights and control the corporation, while preferred shareholders do not.

- Decision-making:Common shareholders have the final say on major corporate decisions.

- Capital structure:Preferred stock can provide a source of capital without diluting the voting power of common shareholders.

Case Studies and Examples

Example 1:, An s corporation may have only two classes of stock

ABC Corporation is an S corporation with two classes of stock: common stock and nonvoting preferred stock. The common stock is owned by the company’s founders, while the preferred stock is owned by investors. The common shareholders have voting control of the corporation and make all major decisions.

The preferred shareholders receive a fixed dividend but do not have any voting rights.

Example 2:

XYZ Corporation is an S corporation with multiple classes of stock. The common stock is owned by the company’s management team, while the preferred stock is owned by outside investors. The preferred stock has a fixed dividend rate that is not proportional to its share of corporate earnings.

The IRS determined that the preferred stock was a “second class of stock” and terminated the S corporation election.

Quick FAQs

What are the advantages of having only two classes of stock in an S corporation?

Having only two classes of stock simplifies the tax treatment of the corporation, reduces the risk of tax issues, and ensures that all shareholders have a clear understanding of their rights and obligations.

What are the tax implications of having multiple classes of stock in an S corporation?

Multiple classes of stock can lead to complex tax calculations, potential reclassification of the corporation as a C corporation, and additional tax liabilities.

What legal and regulatory considerations should be taken into account when issuing stock in an S corporation?

Business owners should ensure compliance with state and federal laws governing the issuance of stock, including the corporate charter and bylaws, and consider the impact of stock classes on ownership, control, and decision-making within the corporation.